These days, just about every software company operates on the

SaaSbusiness model. Compared to most other types of companies, the SaaS industry has a few defining characteristics:

- Subscription pricing instead of licensing fees

- Recurring revenue instead of one-time payments

- Web-based software delivery instead of physical products

- Scalability and comparatively low overhead costs

- Unprecedented insights into users' interactions with the product

Rather than constantly relying on new customer acquisition and constant marketing, SaaS companies can focus on retaining and expanding their current subscriber base. And they can improve their product with data the product sourced for them.

Because of this, there are several unique

KPIs for SaaS companies to measure sales, revenue growth, customer satisfaction, and business health.

While these KPIs apply to all SaaS companies, there are also some key differences in how you should approach them if your customer base is primarily SMBs.

In this article, we'll explore the most important KPIs to pay attention to as a SaaS company serving small or mid-sized businesses and how their interpretation differs from one in the enterprise sector.

Essential KPIs for your SMB SaaS business

Without further ado, let's dive into our comprehensive list of KPIs you need to measure as an SMB SaaS vendor:

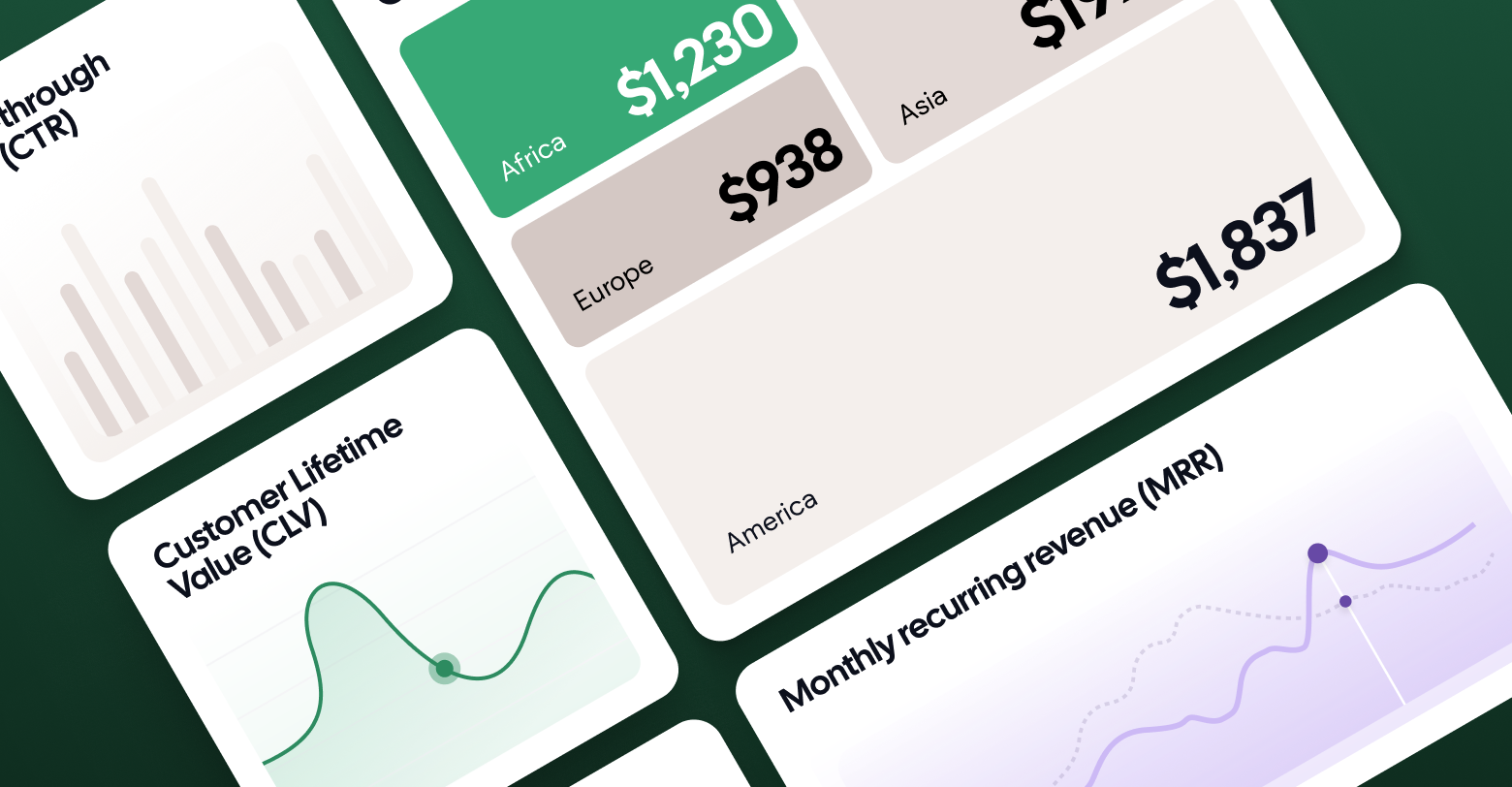

- Monthly recurring revenue (MRR)

- Annual recurring revenue (ARR)

- Customer acquisition cost (CAC)

- Customer lifetime value (CLV)

- Customer churn rate

- Revenue churn rate

- Customer retention rate

- Net revenue retention (NRR)

- Net Promoter Score (NPS)

- Customer satisfaction (CSAT)

- Time to value (TTV)

- Daily and monthly active users

- Average revenue per user

- Gross margin

- Lead-to-customer conversions

- Burn rate

- Product usage

- Sales cycle length

- Marketing channel KPIs

Monthly recurring revenue (MRR)

Monthly recurring revenue (MRR) is the total predictable revenue generated each month from active subscriptions, excluding one-time fees. For SMB SaaS companies, MRR provides a clear, consistent picture of their subscription revenue, which is essential for making business decisions and forecasting future growth.

Since it fluctuates from month to month, companies in the SMB sector focus on MRR to gauge short-term financial health, the effectiveness of sales and marketing strategies, and operational efficiency. They emphasize agility and quick adjustments in response to MRR fluctuations.

By contrast, in enterprise SaaS, it’s generally used alongside more complex metrics to track long-term strategic goals. Longer contract values from large companies mean fewer analyses at the monthly level.

MRR is also typically lower per customer in SMB SaaS, though the total number of customers is higher. In enterprise, it’s the opposite — a much lower total number of customers accounts for total monthly recurring revenue.

Benchmarks vary widely by industry and company maturity, but a common target for SMB SaaS companies is to achieve a net MRR growth rate of15-45% year-over-year (YoY). Companies doing under $2 million in annual revenue will see much higher growth, though.

To track and improve MRR, you should:

- Use automated tools to manage MRR calculations

- Track MRR by customer segments to identify growth opportunities and areas for improvement

- Differentiate between new MRR, expansion MRR, and churned MRR

- Implement strategies to reduce churn, such as offering a loyalty program

- Upsell and cross-sell existing customers

- Regularly analyze churn rates to identify underlying issues

Annual recurring revenue (ARR)

Annual recurring revenue (ARR) is the normalized annual revenue from a company’s subscription-based services. It provides a yearly view of your predictable revenue. ARR gives SMB SaaS companies a long-term view of financial health and stability, crucial for planning, budgeting, and growth forecasting.

While enterprise SaaS companies use ARR to assess strategic growth and market positioning, you’ll focus on ARR to ensure financial viability and manage their operational needs. In the SMB market, ARR is a key metric that can help you attract investors and secure additional funding.

Benchmarks for ARR can vary. According to ChartMogul'sanalysis of companies doing $1 million to $30 million in ARR, the top quartile of SaaS businesses grew at 62.1% in 2022 while the lower quartile grew at just 6.1%.

To monitor and improve your ARR, you need to take the following measures:

- Only include recurring subscription revenues, excluding one-time fees, setup costs, and other non-recurring charges

- Shift your focus to retaining existing customers rather than constantly acquiring new ones

- Incentivize annual subscriptions over monthly ones (e.g., through "one month free" offers for upfront payment)

- Optimize your product pricing

- Upsell and cross-sell existing customers

Customer acquisition cost (CAC)

Customer acquisition cost (CAC) is the total expense incurred by a business to acquire a new customer, including costs associated with marketing, sales, and other related activities. CAC helps you determine the efficiency and sustainability of your customer acquisition strategies. You want to keep your CAC low relative to revenue generated from customers.

SaaS companies with SMB customers often need to be more cautious with their CAC due to tighter budgets and fewer resources on a per-customer basis. While enterprises may afford higher CAC due to larger deal sizes and longer customer lifetimes, SMBs need to focus on rapid payback periods and efficient use of marketing dollars to ensure quick ROI and sustainable growth.

That said, SMB SaaS companies generally have shorter sales cycles with more automated and scalable processes. Online advertising and self-service signups make it easier to close customers. By extension, CAC is lower than it is for enterprise SaaS (though, again, spread out over a larger volume of customers).

A common benchmark for CAC payback period for SMB SaaS companies is around 7 months, with top performers achieving as low as 4 months. For CAC to be considered healthy, the LTV:CAC ratio should ideally beat least 3:1, meaning the lifetime value of a customer should be three times the cost to acquire them. 4:1 or higher indicates a great business model.

To understand and improve CAC, SMBs should:

- Properly allocate wages, commissions, benefits, travel, and marketing spend

- Measure CAC for each marketing and sales channel, customer segment, and product to pinpoint the most profitable ones

- Take advantage of low-cost and scalableSaaS marketing tactics like content marketing,search engine optimization, and word-of-mouth referrals, instead of relying on ads and outbound sales

- Make self-service signups on your website as easy as possible

- Use lead scoring to prioritize leads with a higher probability of converting

- Enhance the effectiveness of your sales team through training and better sales processes

Customer lifetime value (CLV)

Customer lifetime value (CLV) is the total net profit a business expects to earn from a customer throughout their entire relationship with the company. It helps you understand the long-term value of a customer. And it guides strategic decisions on customer acquisition, retention, and overall marketing spend.

The CLV formula is a bit more complicated than the other metrics we’ve discussed:

CLV = (Average Revenue Per User x Gross Margin) / Customer Churn Rate

While it's true that companies in the SMB market generally grow much faster than their enterprise counterparts through quick wins and upselling packages, the lifetime value of the customers they acquire is much lower (because of smaller deal sizes and shorter customer lifespans). So, it's much more challenging to hit that 3:1 ratio needed for healthy CAC.

To monitor and improve CLV, you should:

- Use product and customer engagement analytics to track customer behavior and predict future trends

- Deliver exceptional customer experiences by understanding customer needs and preferences

- Encourage customers to purchase more or higher-value services

- Segment your customers to identify high-value groups and tailor strategies to retain them

- Identify at-risk customers and proactively reach out with solutions to retain them

- Continuously gather customer feedback to enhance your product and service offerings

Customer churn rate

Customer churn rate is the percentage of customers who stop using a company’s product or service during a given period. Since SaaS businesses rely on recurring payments from subscribers, it directly impacts cash flow and sustainability. High churn rates hint at issues with customer satisfaction, product fit, or competitive pressures, and can undermine growth efforts.

Generally, SMBs experience higher churn rates than enterprises due to shorter contract terms (they typically bill monthly), lower switching costs (deal sizes are smaller), and greater price sensitivity from SMB customers.

While it’s true SMB customers have fewer resources and less stable cash flow, switching to another provider is far easier than it is at the enterprise level. Enterprise SaaS products are deepbly integrated into the company’s complex workflow, while SMB SaaS products are more plug-and-play.

SMB SaaS companies generally aim for a monthly churn ratebetween 3% and 7%, translating to an annual churn rate of 36-84%. For early-stage startups, these rates can be higher as they work to establish product-market fit.

To reduce churn, you should:

- Monitor customer health through engagement metrics like product usage, customer support interactions, and NPS surveys

- Identify churn drivers through customer feedback and analyze patterns to address root causes

- Engage with customers proactively to provide solutions or offer discounts before they cancel

- Focus on delivering an exceptional onboarding experience

- Provide excellent customer support and service to build loyalty and trust

Revenue churn rate

Revenue churn rate is the percentage of recurring revenue lost due to customer cancellations, downgrades, or reductions in spending over a specific period.

Revenue churn adds context to customer churn. You might have lost 10% of your customers but only 5% of your revenue if you lost a significant number of low-value customers. However, the inverse is also true — low customer churn could deceive you into thinking things are better than they are when you’ve lost a small number of high-value customers.

Enterprises, with their larger and more stable customer bases, tend to have lower revenue churn rates due to longer contracts and higher switching costs associated with their solutions. However, SMBs can still strive to keep revenue churn to 3-7% monthly by:

- Providing tutorials, FAQs, and in-app guides to help new users understand and effectively use the product

- Offering promotions or discounts to retain at-risk customers

- Upselling and cross-selling to increase the lifetime value of existing customers

- Engaging customers through newsletters, updates, and personalized messages

- Offering flexible pricing plans and contract terms that can cater to different customer needs

Customer retention rate

Customer retention is the inverse of customer churn. It's the percentage of customers who continue to use your product or service over a specified period. High retention rates indicate customer satisfaction and loyalty, which lead to sustained revenue and lower acquisition costs.

In the SMB market, a lack of long-term contracts means lower retention. SMB SaaS companies should aim to retainat least 75-80% of their customer base, from year to year, though top-performing companies achieve retention rates of 90% or higher. Again, early-stage startups might see lower rates as they work to establish product-market fit and refine their offerings.

To improve your retention rate, you need to:

- Understand what drives customer loyalty and satisfaction

- Streamline the onboarding process with guided in-app workflows that highlight valuable product features

- Provide top-notch customer support and timely solutions for any issues or concerns

- Offer rewards, discounts, or loyalty programs for long-term customers

- Continuously gather and analyze customer feedback to enhance your product or service offerings

- Build strong relationships with customers through personalized communication and engagement

Net revenue retention (NRR)

Net revenue retention (NRR) is the percentage of revenue retained from existing customers over a specific period, including expansion revenue (upsells or cross-sells) and accounting for revenue lost due to churn and downgrades.

NRR = (Starting MRR + Expansion MRR − Churned MRR − Contraction MRR) / Starting MRR

For SMB markets, NRR is often more volatile than it is for enterprise SaaS due to more frequent contract changes and the potential for one customer to have a major impact. Regardless, however, a healthy SaaS company will have a net revenue retention greater than 100%. This means that the company is growing its revenue from existing customers, accounting for every potential revenue loss.

Best-in-class companies, however, are at least in the 110-120% range. For example, Zoom's SMB segmentmaintained an NRR of 130%+ for 11 consecutive quarters.

To improve your NRR, you should:

- Focus on customer satisfaction and retention to minimize churn (many customers will naturally grow with your company over time)

- Implement pricing strategies that encourage growth and expansion (e.g., per-user pricing)

- Go multi-product to get more subscription revenue from current customers

- Invest in a customer success team to upsell and cross-sell satisfied customers

- Continually improve and update your existing products to offer more value and drive expansion revenue

- Share helpful content that helps users get the most out of your software

Net Promoter Score (NPS)

Net Promoter Score (NPS) measures customer loyalty by asking customers how likely they are to recommend a product or service to others on a scale from 0 to 10, then subtracting the percentage of detractors (0-6) from the percentage of promoters (9-10).

It's a clear indication of customer satisfaction and loyalty. And SMB customers are more likely to share positive experiences within their networks, making NPS a valuable metric for virality and MRR growth. Since sales cycles are shorter in the SMB market, you can capitalize on happy customers through a customer advocacy program.

Enterprises are a bit different because sales cycles are longer and more relationship-driven. Promoters in the enterprise market are crucial for maintaining relationships and securing long-term contracts.

In the SaaS industry, the average NPS score is+36. Considering -100 indicates there are no promoters and +100 indicates there are no detractors, this number means there are more promoters than detractors by a decent margin.

To improve your NPS, you should:

- Use both transactional and relationship NPS surveys to get a comprehensive view of customer satisfaction at different touchpoints

- Address issues raised by detractors to convert them into passives or promoters, and reinforce positive experiences shared by promoters to maintain their loyalty

- Analyze NPS scores by customer segments to identify patterns and tailor strategies for different groups

- Follow up with customers after they provide their NPS score. Thank promoters and ask for testimonials or referrals. Engage with detractors to understand their concerns and show commitment to improving their experience.

- Combine NPS with other customer satisfaction metrics like Customer Satisfaction Score (CSAT) and Customer Effort Score (CES) to get a holistic view of customer experience

Customer Satisfaction Score (CSAT)

The Customer Satisfaction Score (CSAT) measures how satisfied customers are with a company's product or service. It's derived from survey responses where customers rate their satisfaction with different aspects of the product/service on a scale (e.g., 1-5).

A good CSAT score for SaaS companiesranges from 60% to 80%. Scores above 80% are considered excellent and indicate high satisfaction.

CSAT scores are subjective, just like the questions in the survey are. While enterprise SaaS vendors can focus on strategic account management and tailored customer success programs, SMBs should prioritize quick time to value and broad efforts that benefit as many customers at once as possible. Automation and scalability are key for SMB customer success programs.

To improve your CSAT, you should:

- Conduct CSAT surveys after key customer activities and milestones — onboarding, support interactions, and feature usage

- Use short, clear surveys to increase response rates

- Ask specific questions relevant to the customer's recent interactions

- Act on feedback and address concerns to show your commitment to customer satisfaction

- Market product improvements and updates based on customer feedback to demonstrate you value their opinions and incorporate them into your product roadmap

Time to value (TTV)

Time to value (TTV) measures the amount of time it takes for a customer to realize the expected value from a product or service after the initial purchase or sign-up. It directly impacts customer satisfaction, retention, and the likelihood of turning trial users into paying customers.

Shorter TTV means customers quickly experience the benefits of the product. In enterprise SaaS, longer TTV is expected (due to integration, implementation, and adoption complexity). SaaS vendors in the SMB market, where churn rates are higher and switching costs are lower, are in a race against time to build customer loyalty.

While TTV benchmarks can vary widely depending on the product complexity, a general target for SMB SaaS companies is to achieve TTV within the first 7 to 14 days. There are several ways to achieve this:

- Guided onboarding flows and tutorials to help customers get started quickly

- Easy integration and data transfer with their other tools and platforms

- Personalized support and resources to assist with implementation and troubleshooting

- Simplified user interfaces prioritizing core features that provide immediate value

- AI-driven recommendations and automated processes to help users navigate the platform

- Personalized, in-house support for more complex products

Daily and monthly active users

Daily active users (DAU) measures the number of unique users who engage with a product or service in a single day, while monthly active users (MAU) measures the number of unique users who engage with the product over a 30-day period. DAU and MAU help SMB SaaS vendors understand user engagement and product stickiness.

For SMB SaaS companies, the focus is on easy-to-use interfaces that don't require extensive onboarding assistance or training. High engagement metrics across a large volume of users is critical for demonstrating value and reducing churn. For enterprises, the focus is more on deep engagement by fewer “power” users.

While benchmarks can vary significantly, a good benchmark for SaaS companies is a product stickiness ratio (DAU/MAU) of around 20%.

To increase DAU and MAU, you have to:

- Establish what counts as an active user based on meaningful interactions with your product, such as logins, specific feature use, or content engagement

- Make your core features accessible, and highlight them in your onboarding process

- Ensure your core features are useful in your customers' everyday work, and continue to improve them

- Develop a regular cadence of feature updates and improvements to keep customers engaged

- Continuously engage users with personalized experiences, targeted content, and feature updates

- Use in-app notifications, email marketing, social media, and other channels to remind users about the value of your product and to try new features or updates

- Use analytics to identify patterns among high-engagement users and replicate those experiences for others

Average revenue per user (ARPU)

Average Revenue Per User (ARPU) is a metric that calculates the average amount of revenue generated per user or account over a specific period. A higher ARPU indicates better monetization of the user base, which is essential for growth and profitability.

What constitutes a "good" ARPU is completely relative to the business. For SMB SaaS companies, ARPU is lower than in enterprise SaaS because their customer base is usually more extensive, their pricing is more affordable, and their service offerings are less comprehensive (i.e., “all-in-one”).

To get an idea of what's acceptable for your business, you have to benchmark it against yourself and others in your industry. And for SMB SaaS, there is always the potential for upselling and cross-selling.

To increase ARPU:

- Monitor the growth and behavior of high-value customers for insights on how to attract more like-minded users

- Segment your user base to understand how different groups use and engage with your product, then tailor the marketing, pricing, and support efforts accordingly

- Nudge customers towards higher-priced tiers or additional services, and optimize your pricing for maximum conversions

- Introduce premium features or packages aimed at enterprise-level clients who have more complex needs and can afford higher prices

- Implementing a tiered pricing model that targets different customer segments with varying levels of needs and budget

Lead-to-customer conversions

The lead-to-customer conversion rate measures the percentage of leads that ultimately become paying customers, indicating the effectiveness of a company's lead generation and nurturing efforts. A higher conversion rate means better use of marketing resources and a shorter sales cycle, both of which are essential for the financial sustainability in SMB SaaS.

SMB SaaS vendors generally have higher conversion rates because there are fewer barriers to adoption, prices are lower, and the sales process is much more straightforward. This, of course, goes hand-in-hand with having a more streamlined, self-service product that doesn't require extensive sales or support resources.

The focus here is on volume and sales efficiency. A solid conversion rate is somewhere between 15% and 20%.

To increase lead-to-customer conversions:

- Create a strong and targeted lead generation strategy that reaches your ideal customer through various channels, such as social media, content marketing, and email campaigns

- Use clear criteria to qualify leads as marketing qualified leads (MQLs) and sales qualified leads (SQLs)

- Nurture leads through email sequences, personalized content, and targeted offers

- Shorten the sales cycle through free trials and self-service signup

Burn rate

Burn rate refers to the speed at which a company is spending its cash reserves. In other words, it's the rate at which the company is "burning" through its available funds before generating positive cash flow from operations.

Burn Rate = (Cash Balance Beginning of Period - Cash Balance End of Period) / Number of Months in Period

Burn rate only matters for early-stage startups that don't have a steady stream of revenue yet and rely on funding for survival. In the SMB market, burn rates are lower than in the enterprise market because they have smaller teams and can automate more of their processes. Enterprise SaaS vendors usually have high burn rates because of their larger sales and support teams.

For SMB SaaS companies, a general benchmark is to have 6-12 months of expenses on hand. So, if you have $1,000,000 in the bank, you should be spending between $83,333 and $166,666 per month at most to have acceptable capital efficiency. And SaaS startups should maintain a burn multiple (the ratio of cash burned to net new ARR) below 1.5.

To improve burn rate, scalability and efficient growth are crucial. You have to:

- Keep detailed records of all expenses and revenue

- Regularly review and categorize all expenditures to identify areas where costs can be reduced without compromising essential business functions

- Focus on strategies to increase recurring revenue

- Calculate your financial runway (the amount of time you can operate before running out of cash) and take steps to extend it

- Develop different financial scenarios to anticipate potential future conditions

Product usage

Product usage metrics track how customers are engaging with your product, such as frequency of use, time spent on the platform, and features used. They help you identify how customers derive value from the product, which features are most popular, and where there may be friction points.

For SMB SaaS platforms, the main focus is on broad usage and feature adoption, rather than deep integration and customization. While deep, specialized usage for complex business needs is the focal point for enterprise customers, SMB SaaS products have to be intuitive and have fast TTV.

The data for product usage will come directly from your software. It's vital to have a robust analytics tool in place to track usage across the product accurately.

To maximize engagement with your product:

- Track essential product usage metrics such as DAU, MAU, feature adoption rates, and time spent in the product

- Use tools like Google Analytics, Mixpanel, and ProfitWell can help automate this tracking

- Segment users based on their usage patterns and tailor your engagement to different segments

- Use in-app guides, tutorials, and checklists to facilitate onboarding

- Implement mechanisms to collect continuous feedback from users about their experience

- Identify and promote the most valuable features of your product

Sales cycle length

Sales cycle length is exactly what it sounds like — the duration from the initial contact with a prospect to the final closing of a deal. The faster you can close a deal, the more revenue you can generate in a given period. By extension, the more profitable you become.

In SMB SaaS, sales cycles are much shorter because the buying process is less complicated and involves fewer decision-makers. Enterprises have complex needs assessments, negotiations, and approvals from various stakeholders.

Still, the average SaaS sales cycle lasts84 days. So, closing even one deal requires a lot of effort and resources.

To shorten your sales cycle:

- Break down the sales process into distinct stages (e.g., lead generation, qualification, demo, negotiation, closing) and track the time spent in each stage

- Implement rigorous lead qualification criteria to ensure that sales efforts are focused on high-potential prospects

- Qualify leads with a framework like MEDDIC to capture essential information as early as possible

- Use sales automation tools to streamline communication and follow-up processes

- Deliver value early in the sales process. through product demos, free trials, and personalized consultations

Marketing channel KPIs

Depending on the channels you use to distribute your content and market your product, these will differ. The most common channels for SMB SaaS companies are web content, social media, and paid ads because they’re the most accessible with lower marketing budgets. SaaS businesses targeting enterprise companies will also use industry publications, conferences, and partner networks to reach decision-makers.

The KPIs you should track for each channel will vary, but some essential metrics to consider are:

- Web content: Website traffic, bounce rate, time spent on page, conversion rate, and click-through rate on CTA buttons

- Social media: Number of followers, engagement rate (likes, comments, shares), referral traffic from social platforms, and conversions from social ads

- Paid ads: Cost per click (CPC), cost per lead (CPL), conversion rate, and return on ad spend (ROAS)

To optimize marketing channel performance:

- Track KPIs for each channel to identify which are most effective in driving website traffic and conversions

- Create high-quality content that resonates with your target audience and encourages engagement (e.g., likes, shares)

- Optimize your web content for search engines to maximize organic visibility

- Regularly test and optimize ad creative, messaging, and targeting for paid ads

- Use social media analytics to identify peak posting times and topics that generate the most engagement from your audience

Duda helps SMB SaaS companies reduce churn and diversify their revenue streams.

Going multi-product is one of the ultimategrowth hacks for SMB SaaS. And it's something you can do with Duda.

Combining your core SaaS product with Duda'swebsite builder creates the perfect opportunity to upsell your current customers and attract new ones. Not to mention, customers are far less likely to churn when they rely on your platform for something they use every day (their website). Considering that every company needs a website,

integrating Duda directly within your core product offering fills a crucial gap for your customers. Whether you're selling a CRM, project management software, or email marketing tool, a website makes your solution more comprehensive and eliminates the need for them to manage separate platforms.

A few examples:

- Shazamme achieves 90% Demo Conversion Rate and high Customer Satisfaction with Duda

- With websites built on Duda, property management software

DoorLoop reduces customer churn by 50%

- Broadly achieved 29% higher MRR by partnering with Duda to create a website offering for SMBs in the pet, home services, and automotive industries

Ready to maximize your SaaS KPIs with minimal effort? Want to learn more about how Duda can help your SaaS company?

Contact us!