What is a tariff?

Tariffs are not new. In fact, during the 19th-century

tariffs accounted for about 95% of all of the United States' revenue. That’s to say that if your clients have been importing goods from abroad, they’ve likely

already been paying tariffs. So wait, what even is a tariff?

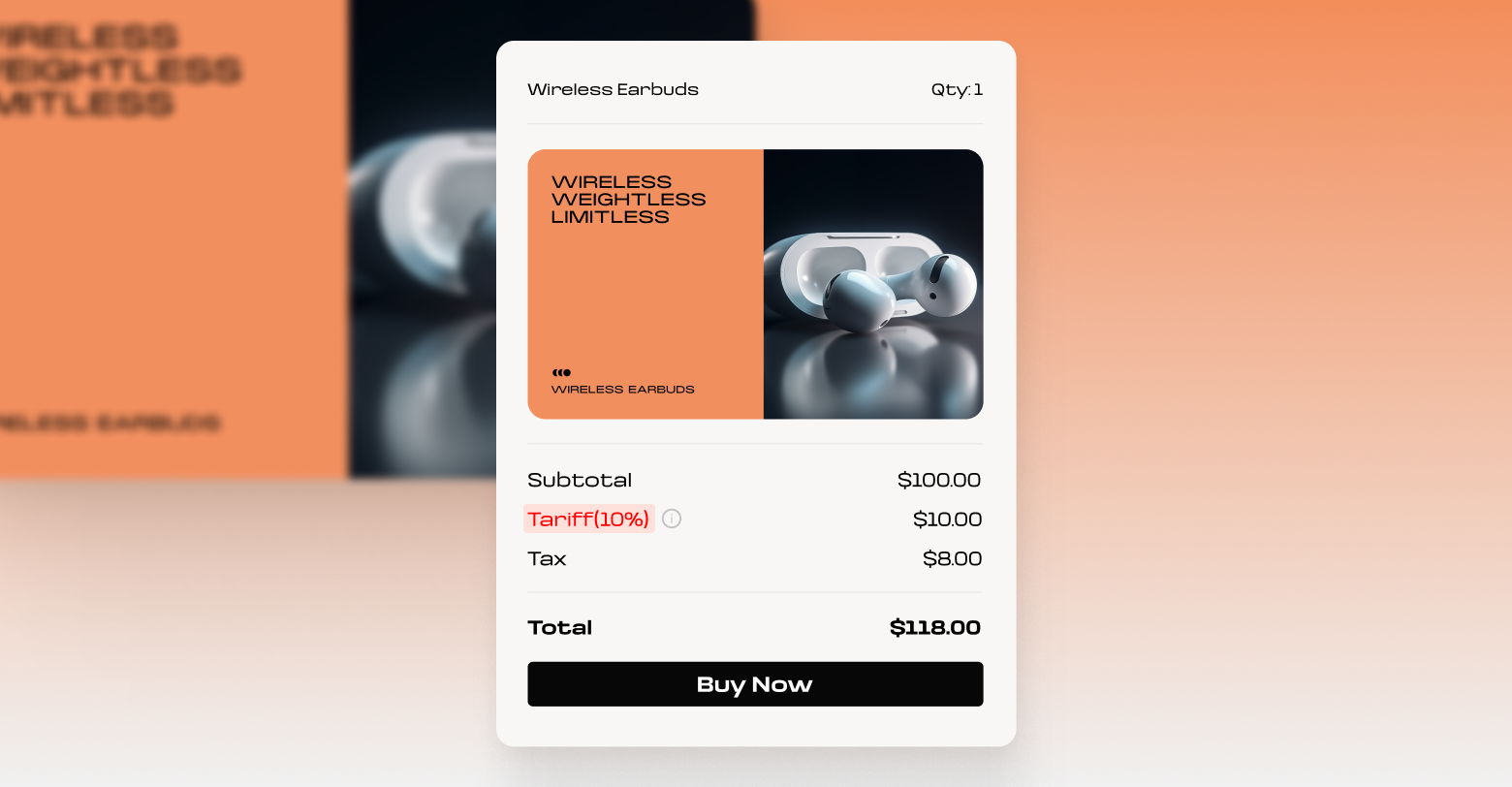

A tariff is essentially

a tax imposed on imported goods, levied by a government when a product crosses a country's border, before it enters the domestic economy.

Suppose, for instance, that your client is selling insulated mugs with their logo printed on them, and they’re purchasing those mugs wholesale from AliExpress, a Chinese-based marketplace that connects factories with international buyers. When that pallet of mugs enters the United States, the importer is required to pay a fee to the United States Treasury based on the value of those mugs.

Most importers bake this into the price of their goods, handling it themselves at the border. That means your clients are probably not cutting checks to the treasury for imports themselves. SMBs rarely form direct relationships with factories and handle imports themselves, after-all.

However, the United States isn’t the only country enacting tariffs—economic relationships work both ways. Many countries already have, and

may even be expanding, tariffs against the United States. If your clients sell internationally,

a practice that is pretty rare for SMBs, they may need to pay those tariffs themselves unless they’re working with an exporter.

Keep in mind that Duda does not calculate duties or tariffs within the platform. Instead, we strongly recommend that those clients consult a tax professional for specific guidance.

How will tariffs impact my clients?

How much impact tariffs will have on your client depends heavily on the distinct circumstances of their business. With new tariffs expected to impact

about 90 nations, we can’t possibly touch on every possible combination of import and export situations. Instead, we’ll take a look at three client personas; those who ship domestic products or services domestically, those who sell foreign products domestically, and those who sell domestic products abroad.

My client sells domestic products domestically

Congratulations! You can take the rest of the day off. Tariffs exclusively apply to imports. If your client’s eCommerce store is purely domestic, like a restaurant selling reservations or gift cards online, then, from an eCommerce perspective, tariffs do not impact them.

Notice I said “from an eCommerce perspective.” That’s because very, very few businesses are truly insulated from the

complex global supply chain. Sticking with the restaurant example, some of their business supplies, like chemical cleaning agents or raw ingredients, may, at some point, have been imported. Depending on from where, they could see increases to their wholesale prices, which, in turn, could trickle down to their own prices.

That’s a long-winded way of saying that if the price of coffee increases, cafes may need to increase the price of their lattes to maintain healthy margins. As an agency, you should recommend to these clients that they communicate the facts of their situation with their customers

early and often.

My client sells foreign products domestically

A sizable number of your clients are going to fall into this bucket. The United States is the largest goods importer in the world, with

$3.2 trillion worth of imports in 2022. In this situation, your clients will undoubtedly need to raise their prices to account for changing market conditions. How much, though, depends on how they imported previously.

There are two major ways SMBs import products; in bulk or individually. The latter, individual imports, are increasingly popular among SMBs because they minimize risk and overhead. Colloquially, we call this practice “dropshipping” and it accounts for

23% of all sales in the eCommerce industry.

When an SMB dropships goods, they alleviate the need for storage and up-front payments. Rather than purchasing and warehousing 1,000 t-shirts, they could instead ship individual shirts printed abroad to domestic customers “just-in-time.” Until recently, this practice had another benefit too; no tariffs.

As mentioned earlier, the recently revoked “de minimis” exemption allowed for packages under $800 in value to enter the United States without undergoing formal customs procedures. That meant no paperwork and no import duties. Companies like

Temu and Shein previously leveraged the de minimis exemption to export low-cost goods to U.S.-based customers without needing to pay tariffs. Dropshippers largely did the same.

If you have any clients who participated in direct-to-consumer dropshipping, they should expect a

significant increase in their import costs. To maintain margins, these clients should expect to raise their prices in tandem. As an agency, you should recommend that they communicate the facts of their situation with their customers

early and often.

My client sells domestic products abroad

This is the most unlikely scenario for an agency to face, and also the most complex. We strongly recommend that any clients in this situation work with an expert, third-party exporter. The foreign tariff situation is

rapidly evolving. Our advice applies to non-US businesses selling domestically-produced goods to customers residing within the US as well. Some large companies,

like Nintendo, have halted the sale of new products while they assess the impact of tariffs on their prices. If your SMB can afford to pause their exports, they should consider doing the same while the dust settles.

Will tariffs impact my agency?

It’s very hard to say. Agencies operating outside of the United States, but providing digital marketing services to businesses residing within the United States, are, as of the time of publication, not subject to any of the tariffs announced by the White House on April 2nd. These tariffs largely focus on goods, while, under international trade law, digital marketing is classified as a service.

That’s not to say that international agencies are immune. Some members of the European Union have begun instituting

Digital Services Taxes (DSTs) that take aim at large corporations providing, well, digital services in the bloc. The United States has

begun research into this as well.

It is unlikely that any digital marketing agencies are going to fall within the purview of any DSTs instituted by the United States government. However, it’s a development worth watching nonetheless.

What advice should I give my clients?

The million dollar question for agencies responding to tariffs; “What should I tell my clients?” If you read all of the entries in the impact section of this article, you’d notice a common theme—in every scenario, your clients may need to raise their prices.

Raising prices is not ideal. Customers are

increasingly price sensitive, and your clients will likely not see any additional revenue after instituting a price hike. Together, this is a lose-lose situation that will undoubtedly garner some amount of negative business impact.

Thankfully, as a marketing agency, you’re in a unique position to minimize the blow. Positioning can go a long way! By communicating with your clients' customers

early and often, you can increase trust and maintain positive sentiment.

If your clients have an email list, send something

as soon as possible—even before your clients know if they need to raise prices. Let their customers know that you’re monitoring the situation and that you’re doing everything you can to minimize disruptions. Doing this lets your clients know that everyone is on the same team and underscores the reality of the situation, which is that any price increases are

not your customers fault.

In fact, this should be your clients’ main message going forward; price increases are due to

external factors beyond their control. Communicating this, however, is a delicate balance. While customers value transparency, they hate excuses. Aim for copy that comes across as level-headed and human, not desperate or confused. Instead of saying that you “don’t know” the impact of tariffs, say that you’re “exploring every avenue available to us” in regards to handling them. Prioritize action words, even if the meaning is fundamentally the same.

If prices do increase, communicate this on product pages directly. Take advantage of editor features like the

Advanced Accordion with FAQ schema to explain as transparently as possible how tariffs contributed to increasing prices. You can either reference the tariffs directly, or you can use vague-er language such as “increases in wholesaler prices.”

That brings us to the final communication hurdle your agency is going to face; tariffs are a political issue in the United States. A subsection of your client’s customers may be in-favor of these new tariffs, and disparaging language may invoke a negative perception of your client’s brand. Similarly, language in favor of tariffs could elicit a similar reaction among a different subsection of your client’s customers. While

opinionated marketing can, in times, lead to great results—this is such a variable situation that we’d recommend sticking to neutral language instead.

Takeaways

- The international trade of goods is in a state of flux, your clients need to be prepared to raise their prices.

- Communicate with your clients’ customers as soon as possible, letting them know you’re aware of the situation and are exploring your options.

- Discuss the impact of tariffs in a consultative, level-headed, and neutral way. Deflect responsibility for price increases without seeming “victimized” by it.

For further reading, we’d recommend taking a look at some timeless articles about overcoming negative feedback to price increases.

Our partner,

Avalara, is producing a large number of quality resources for businesses more directly impacted by tariffs than your typical SMB, particularly those who import and/or export products themselves.

Update

Update