If you’re coming from the world of software, you are likely well aware that retaining your customers is much more profitable than paying to acquire new ones.

That’s because the cost of customer acquisition tends to increase rapidly. Instead, to better grow your business, you need to focus on making your active customers more profitable and longer-lasting.

As basic as that may seem, many

SaaS companies tend to analyze their business through the perspective of

MRR or ARR (Monthly and Annual Recurring Revenue) and sales velocity, forgetting about NRR (Net Revenue Retention), which can provide an even better long-term view of the company.

Why is that important?

Imagine a chicken trying to fly—it may get a little airtime but it won’t go very far. Just like the chicken, a company that has a growing MRR through new sales and customer acquisition efforts but a low CLTV (Customer Lifetime Value) is in for a short flight.

In other words, if your churn isn’t under control, there won’t be real growth in the MRR of your active customer base—no matter how fast it grows and how many new sales you make. The ultimate revenue you’re seeking will never be achieved!

What is net revenue retention (NRR)?

Net Revenue Retention is a percentage metric that illustrates the amount of revenue from your active customers that you are able to retain and expand over a specific period. This equation considers values like upgrades, downgrades, and churn.

It’s not as well-known as MRR or ARR, but it’s quite important—especially for SaaS companies. That’s because it’s exceedingly common for these businesses to increase their MRR but still lose money.

Yes, you read that right; it’s possible, and quite likely, for a software company to reach a point in its growth where it expands its MRR but ultimately loses money.

This scenario occurs when marketing and sales teams are operating at full capacity, and customer acquisition is outpacing the ability to retain and expand accounts.

Let’s take a practical example. Your SaaS started this month with $100,000 in MRR. Of that amount, $50,000 came from NMRR (New Monthly Recurring Revenue) from newly acquired customers. However, you also lost $20,000 in downgrades, earned no upgrades, and lost an additional $5,000 in churn.

In this example, your MRR increased by 50%. While that’s a figure worth celebrating, your NRR is only 75%—leading to a 25% decrease in MRR from your active customer base. That’s a pretty significant hole in your bucket! Once you analyze your CAC (Customer Acquisition Cost), does it add up?

The perfect formula: Increase your MRR and reduce churn

The formula for achieving a good NRR involves working on two pillars: Boosting MRR and “holding onto” the decrease in MRR, primarily by avoiding churn. Let’s break it down:

Boosting MRR

The two main mechanics for boosting MRR are through acquiring new customers or upgrading existing ones.

The process of upgrading your existing customers is called “upselling,” and can generally occur in two ways:

- Offering new features or tools only available in a more expensive subscription tier.

- Expanding any usage limits applied to your existing software, such as increased database sizes, more accounts, or increased bandwidth.

Losing MRR

Your business relies heavily on keeping active, paying customers subscribed to your service for as long as possible. With that in mind, loss of MRR from customers can occur in two ways:

- Through downgrades, which would represent a partial loss of revenue from a customer.

- Through churn, which would represent a complete loss of revenue from a customer.

Account cancellations are the worst case scenario for subscription-oriented businesses. Not only do you lose out on future payments from that customer, but any additional revenue from potential upsell opportunities has vanished.

How can I calculate my company’s NRR?

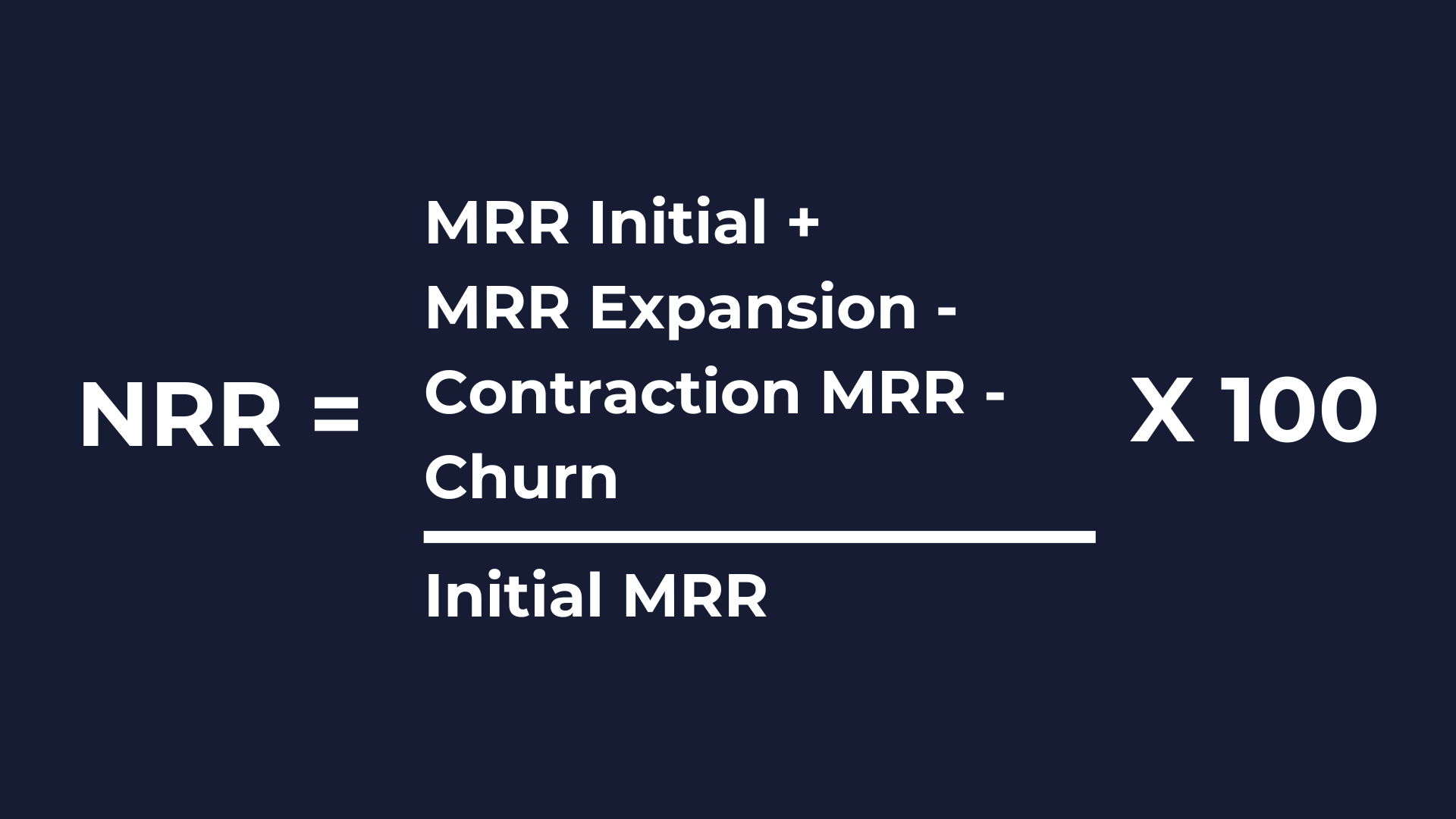

The formula for calculating NRR takes into account the following elements over a specific period:

- Initial Monthly Recurring Revenue (MRR Initial)

- Upgrades (Expansion MRR)

- Downgrades (MRR Contraction)

- Churn

If you plug in the values from our example at the beginning of this article, your NRR would be 75%. Any value under 100% indicates a potential loss in revenue. Therefore, in this example, if you were to stop selling new accounts your company would lose 25% of its monthly revenue.

What is a good NRR?

To start, understand that an NRR below 100% should be investigated as soon as possible. What if your NRR is higher, though? What would a good value be?

A review of

40 publicly traded SaaS companies found a median 109% NRR. Consider this a good reference point.

Box led the pack with over 120% NRR—a great result for a SaaS company!

How can I improve my NRR from now on?

Product strategy

If your product truly adds value and facilitates their entire journey as they mature in their use of your product, then you’ll automatically achieve the lock-in you’re seeking. Customer adoption of your product is a crucial element in decreasing churn and, additionally, paving the way for upgrades down-the-road.

Go-to-market strategy

If your strategy for acquiring new customers is not aligned with your Ideal Customer Profile (ICP) then you risk onboarding new accounts that just won’t stick. This can undermine an otherwise successful retention strategy and seriously harm your NRR. Instead, ensure that you’re reaching customers who are the right fit.

Retention strategy

Suppose you have a great product and a well-thought-out Go-To-Market strategy, but you’re still experiencing churn. In this scenario, you’ll want to take a look at your Customer Success operation. Consider your customer’s journey from the moment of onboarding to the day-to-day interactions. You want your clients to thrive when using your software. This is a good moment to consider upsell paths as well.

There are many ways to improve upon these three strategies. You could improve your added value offerings, increase the stickiness of your product, or refine your customer support offering.

Many of our own customers have found great success in offering websites to customers.

Appfolio, for example, saw a 4.8% decrease in churn and a whopping 34% increase in value added services.

So, how's your NRR?